Project Reference

Equias – energy post-deal OTC processing

Equias – powering Europe’s energy markets since 2004

Wholesale trading of energy in Europe is a relatively recent phenomenon. It started with the liberalisation of energy markets driven by the EU in the 1990ies. From that time on, network operators were separated from utilities, and trading organisations came into their own. For a while, prices and volumes went in one direction only: Up. Life was a party, until Enron went bankrupt in 2001. This took the air out of the room. Having the right clauses in master agreements, a good and current assessment of counterparty risks and exposure, and proper documentation of trades became very valuable. This put the spotlight on the Back Office and Risk Management of trading organisations, a part of the business not nearly as glamorous the Front Office, where trades are executed. But the Back Office is where the ledger is kept, trades registered, and risks checked. And the Back Office was using paper, faxes, e-mails, lists, and post-it notes. Lots of post-it notes. Energy trading was still young, new trade instruments were developed all the time, and new counterparties entered the market. While profits were high and risks perceived to be low, it seemed ok to run this business in a manual and rather haphazard way. After Enron, not anymore.

Luckily, an industry association ready to step up to the task already existed: the European Federation of Energy Traders (EFET) had been created in 1999, two years prior to the Enron crash. Its biggest achievement at the time had been the EFET Master Agreement, which facilitated standardized trading on the OTC markets, outside of cleared exchanges. The EFET master Agreement allowed traders to reduce their exposure to insolvency of counterparties to the net amounts owed. Since most trade relations between the bigger players in the OTC energy space are two-way, with both parties buying and selling, this drastically reduced the risk of trading. EFET had a task group for the Back Office, which took on the challenge of standardising and automating the trade confirmation process. This workgroup created the first XML-based standard for electronic Confirmation Matching, or eCM.

Before eCM came along, parties to each OTC trade would exchange faxes or e-mails with the trade details, with people on each end checking these for differences – a truly tedious job. A common error would be directional: Both parties to the trade erroneously entered a trade as a “Buy”, when in fact only one of them had been the seller. Such an OTC forward would then linger in the books until the start of delivery, sometimes years in the future. At such time, the error would become apparent – with the actual seller now having to deliver the power and cover the shortfall in their own portfolio as well. With the spot price very different from the original price, suddenly having to purchase twice the original volume could be very costly – up to millions of Euros in case of a substantial base load deal.

eCM allowed counterparties to the trade to immediately exchange their view of the OTC trade they had entered into with each other, with an automatic matching process spotting any discrepancies right after the trade had been registered. Thus the risk of a trade not registered properly went away, while the manual effort in the Back Office was drastically reduced. Over time, Back Office teams would be handling twenty times the original volume of trades before eCM, without adding additional staff.

Ponton came into the EFET story via London, where the success story of papiNet was presented at a conference in 2003. After initial contact with the EFET team, the success factors behind papiNet were transferred into the energy space: data format (EFET eCM) was already available, as was a business process. Ponton added Ponton X/P, supporting the communication protocol ebXML and proposed closing a master deal to make licenses to the software available to all traders in the European energy space. To this end, a subsidiary company of EFET had been created, which was aptly called EFETnet. PONTON also build the matching logic, at first in a decentralised system comprised of components called EFET Box. The first live matches and acceptance of the system took place in March 2005, with Barclays, EDF Trading, Electrabel, Gaselys, RWE and Total as the first movers.

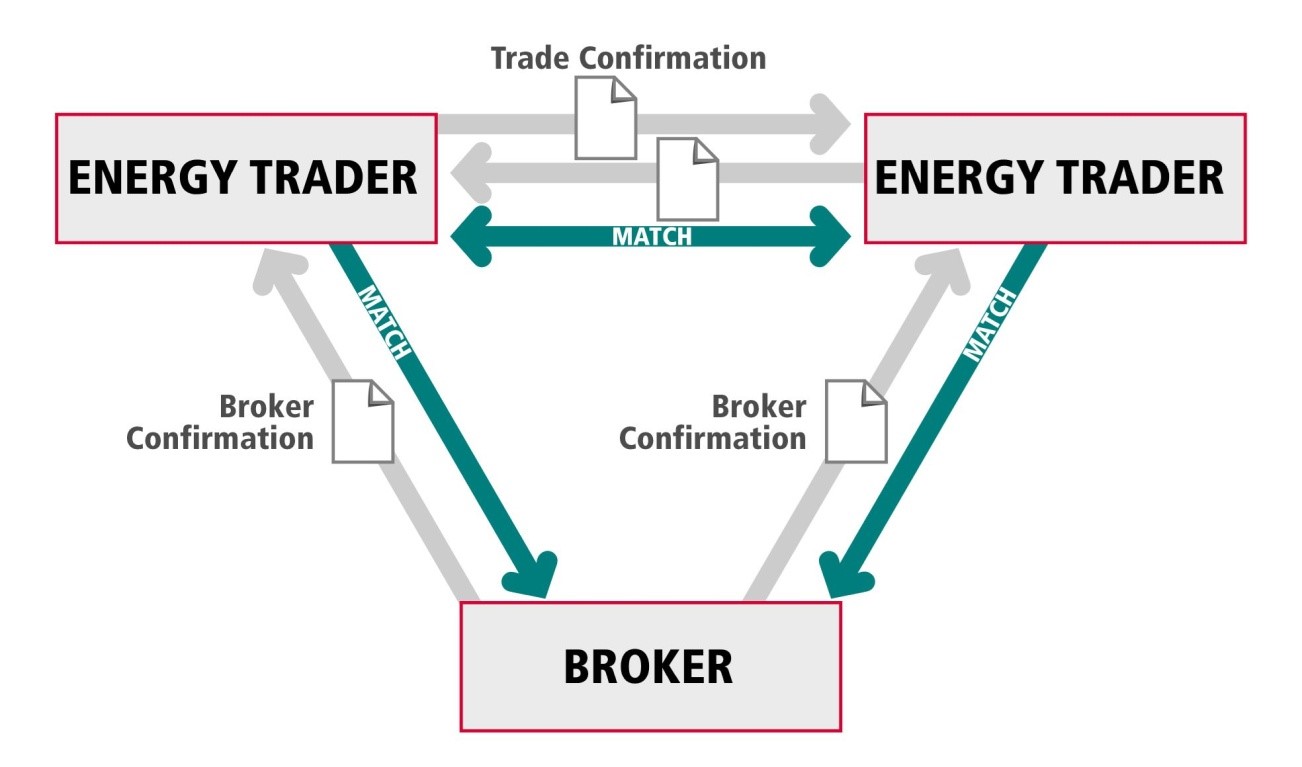

After eCM had been created for bilateral trades between traders, brokers got added to support trilateral matching. This complicated the process, but the added safety of having the trade details checked against the data from the broker systems was valuable. Over time, the system grew to some 50 traders and 6 brokers and did not stop there. Managing the technical peer-to-peer communication became a burden, with admin and IT staff having to watch for outages, update certificates and manage master data. From 2009 to 2011, Ponton rebuilt the system by instituting a Central Matching System, or CMS. Now each trader or broker had only one communication link to look after, which was still built on the secure and confidential protocol handled by Ponton X/P. Since the CMS supported a hybrid model with central matching and peer-to-peer matching at the same time, no big bang migration was needed. In 2011, the migration was complete, with 80 traders on the CMS.

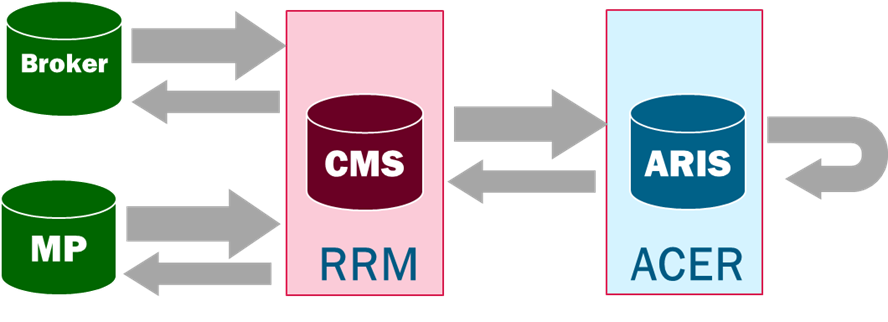

This was very good timing, because in 2015 the European REMIT implementing act made reporting of energy trades to the new EU organisation ACER mandatory. Before that, the financial crisis of 2008 had brought the packages of MiFID and EMIR. Since EFET had already standardised the trade details for purposes of confirmation matching, it was straightforward to extend the standard to also cover electronic Regulatory Reporting (eRR). Ponton extended the CMS to cover these regulatory processes. Since virtually all brokers relevant to energy trading in Europe had already been connected to the CMS, reusing that connectivity to allow for REMIT reporting of brokered trades was the natural next step. eRR became a big success story, allowing more than 1’500 energy companies across Europe to fulfil their compliance mandate.

Today, Equias with the system CMS built by PONTON is the undisputed market leader in OTC post-deal verification and compliance for energy traders in Europe.