PONTON BLOG

ETCSEE 2024

Eat – Sleep – Trade – Repeat

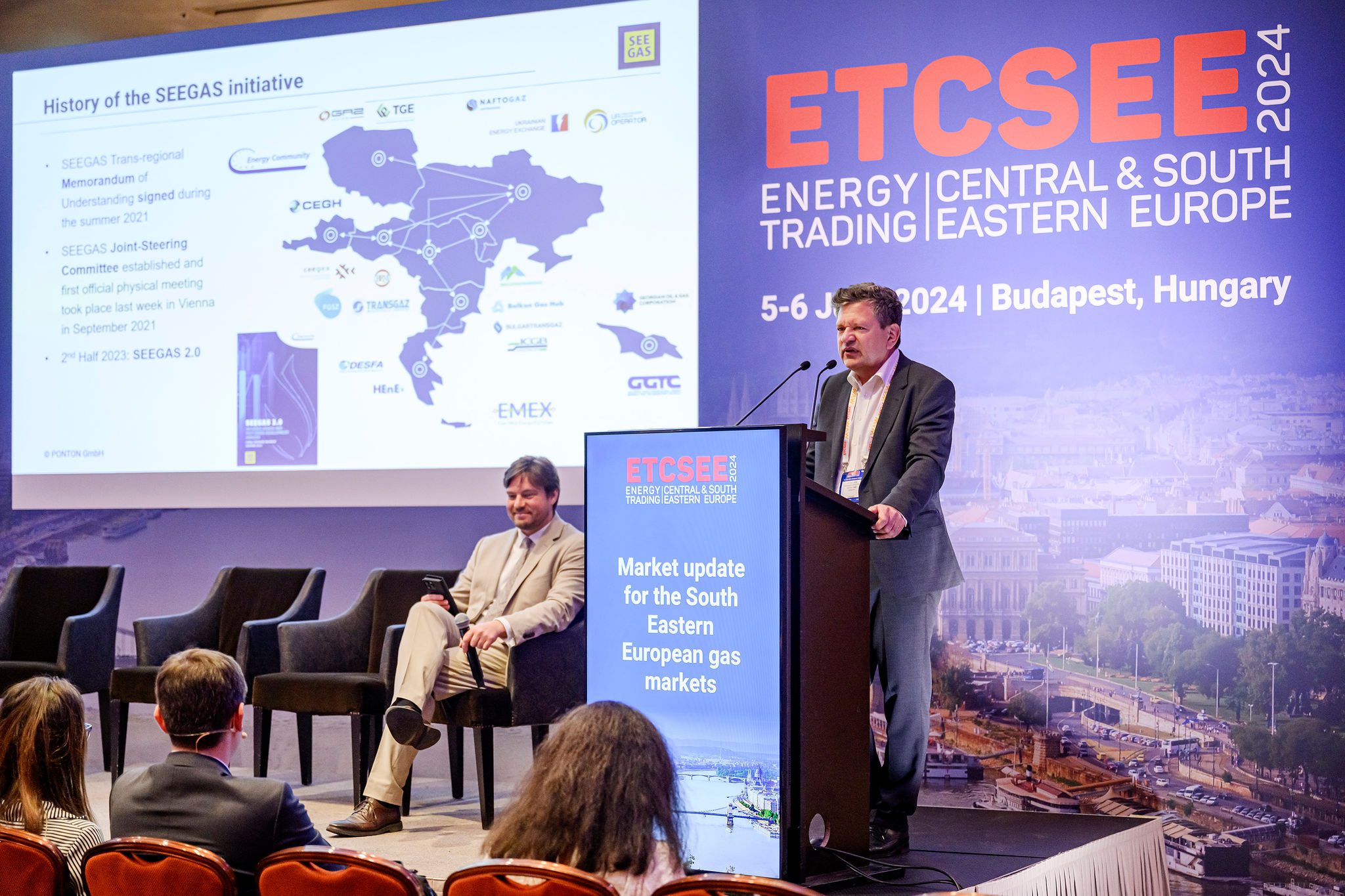

Just coming back from the ETCSEE 2024 conference in Budapest – the signature conference on energy trading in Central and South-East Europe with 600 participants. Contratulation to the organisers! Demand was higher than supply: no more registrations than these 600 could be accepted due to capacity limitations.

As every year, ETCSEE focused on developments in the CSEE gas markets (I attended only the gas sessions). One topic was the “Vertical Corridor” – a streamlined supply with the possibility to store gas delivered via Greece, Bulgaria, and Romania in Ukrainan storage facilities. Today many factors still hinder this supply:

- “Pancaking”: A stack of TSO fees between Greece and Ukraine (accounting for up to €10 per MWh in total) burdens the commodity price of €20-25. TSO cooperation is needed here on the physical side and new end-to-end products will help on the trading side.

- Regulation: As long as energy trading is taxed at 98% of the traders’ gross profit, Romania will remain a dead energy market. Under these circumstances, trading there is by definition a loss-making business.

- Congestion at some interconnection points drives prices up and prevents market liquidity.

- Finally, energy trading could benefit from a number of standardisations that could be achieved: standardsised products, standarised clearing services, standarsdised admission processes by regulators, exchanges, clearing houses, and TSO.

To dig deeper here, Aura Sabadus of ICIS asked clearing house operators, why there is no standardisation across the region. The answer was unspecific: There are too many specific problem…

But if you ask the members ( = market participants), they will give a clear answer on what the solution should be: “One currency, one trading platform, one clearing house”. However, the reality is this today:

- There is one EMIR-compliant clearing house in the market, however, some functions are outsourced here to ECC. The bad news: this is required by the regulator to be terminated in the future.

- There is a nearly-EMIR-compliant one, the main gap is in the default waterfall, where the “skin-in-the-game” step comes later than required by EMIR.

- There is another non-EMIR clearinghouse, which does not act as a CCP, but as a settlement counterparty. As a result, cost of risk management is lower for clearing members but on the flip side of the coin, more risk remains on the market side.

- Furthere, there are exchanges which offer a settlement service to their trading members, where the lack of a default waterfall is usually compensated by higher margin rates.

- Finally, there is an exchange lacking any post-trade processing – after a trade is executed, the trade execution data is sent back to the two counterparties. This is actually the way OTC brokers work – but there is light at the end of the tunnel here: a clearing solution will soon be implemented.

So, all-in-all we see a range of solutions in the CSEE region which are not compatiple with one another.

In my view, it does not matter what level of risk management is ultimately used in the region (all the first three a capable for doing the job), but it must be one solution across markets. This will help reduce uncertainty, increase market liquidity (currently, there is almost no churn rate > 1 in the CSEE markets), and pave the way for derivatives (especically trading spreads is demanded here).

So, the ETCSEEs in the coming years will remain highly attractive as a platform for innovation in the market. I’m looking forward to Vienna 2025!